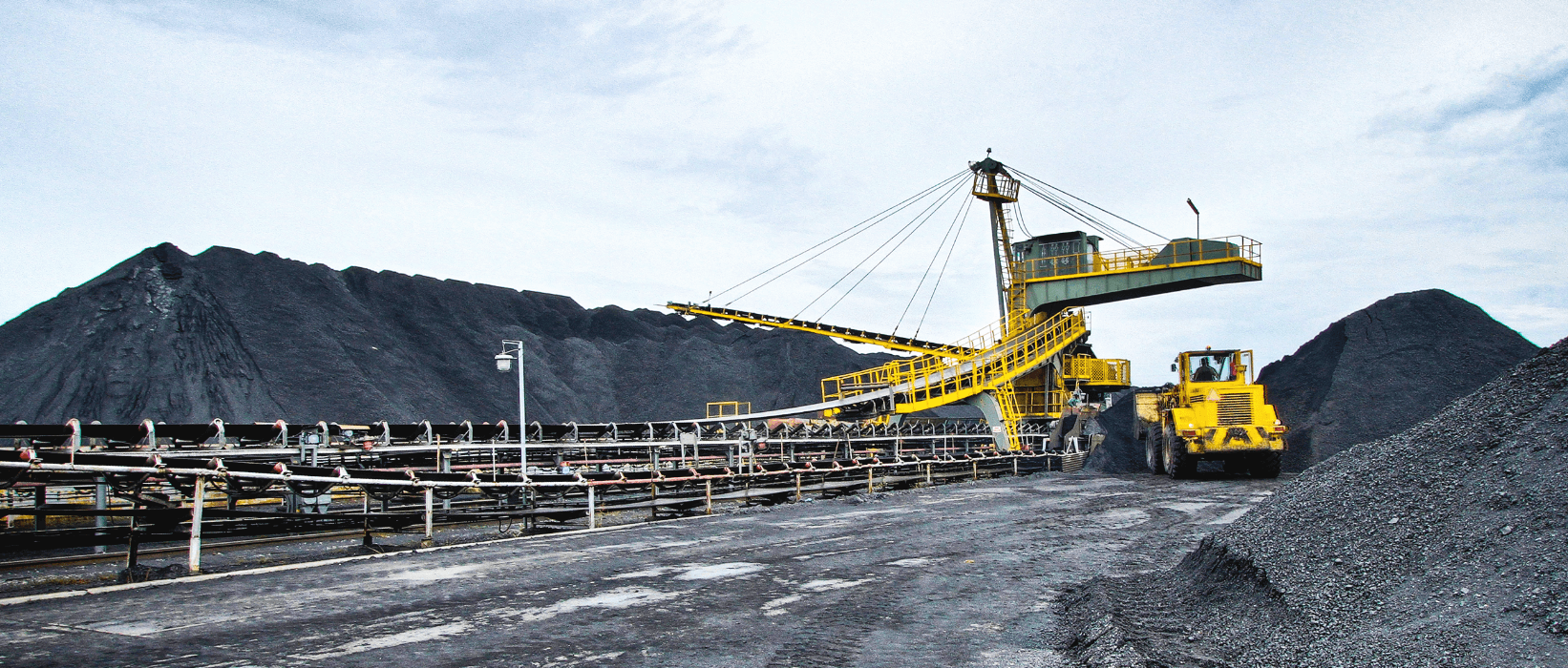

Within ENEA Group, mining activities are conducted by a subsidiary, Lubelski Węgiel Bogdanka S.A. (hereinafter: LW Bogdanka). LW Bogdanka is one of the leaders on the market of producers of bituminous coal in Poland, distinguishable within the industry in terms of the generated financial results, coal extraction efficiency and investment plans providing for the access to new deposits. The bituminous energy coal sold by the Company is used primarily for the generation of electricity and heat and for the production of cement. The Company's customers are mainly industrial companies, mostly entities operating in the power industry located in eastern and north-eastern Poland.

Generation

| ENEA Group’s generation assets | ||||

|---|---|---|---|---|

| Installed electrical capacity [MWe] | Attainable electrical capacity [MWe] | Installed heating capacity [MWt] | Installed RES capacity [MWe] | |

| Kozienice Power Plant | 4,071.8 | 4,020 | 125.4 | - |

| Połaniec Power Plant | 1,837 | 1,882 | 130 | 230 |

| Bardy, Darżyno and Baczyna (Lubno I and Lubno II) wind farms | 71.6 | 70.1 | 0 | 71.6 |

| Liszkowo and Gorzesław biogas plants | 3.8 | 3.8 | 3.1 | 3.8 |

| Hydroelectric plants | 58.8 | 55.8 | 0 | 58.8 |

| MEC Piła | 10 | 10 | 135.3 | - |

| PEC Oborniki | 0 | 0 | 27.4 | - |

| ENEA Ciepło (Białystok Heat and Power Plant, West Heat Plant) | 203,5[1] | 156.6 | 684.1 | 78,5[1] |

| Total [gross] | 6,256.5 | 6,198.3 | 1,105.3 | 442.7 |

[1] In accordance with the decision of the President of ERO amending the. Electricity Generation Licence (EGL), the installed RES capacity at Białystok Heat and Power Plant has changed as of 9 May 2019

CO2 emissions

| Kozienice – Power Plant [t] | Free CO2 emission allowances [t] | Costs of allowances [PLN] | |

|---|---|---|---|

| 2018 | 14,076,969 | 2 187 758 | 324,672,994.2 |

| 2019 | 14,883,264 | 1 719 943[2] | 834,265,665.03 |

| MEC Piła | Free CO2 emission allowances [t] | Costs of allowances [PLN] | |

| 2018 | 84,107 | 18 197 | 5,493,511.19 |

| 2019 | 80,450 | 14 954 | 6,276,583.02 |

| Białystok Heat and Power Plant | Free CO2 emission allowances [t] | Costs of allowances [PLN] | |

| 2018 | 280,147 | 104 834[3] | 23,930,174.8 |

| 2019 | 253,522 | 87 180[4] | 16,867,573.66 |

| West Białystok Heat Plant | Free CO2 emission allowances [t] | Costs of allowances [PLN] | |

| 2018 | 19,753 | 69 612 | 410,396.8 |

| 2019 | 12,254 | 68 213 | 1,480,174.14 |

| Połaniec – Power Plant | Free CO2 emission allowances [t] | Costs of allowances [PLN] | |

| 2018 | 8,219,329 | 129,321 | 211,724,216 |

| 2019 | 6,751,791 | 126,099 | 411,162,327 |

| Total 2018 | 22,680,305 | 2,440,806 | 566,231,293 |

| Total 2019 | 21,981,281 | 1,948,858 | 1,270,052,323 |

[2] Accounting treatment

[3] One-off allocation of free CO2 emission allowances for 2018

[4] One-off allocation of free CO2 emission allowances for 2019

Distribution

Length of power lines

Length of connections

Number of transformer stations

Number of connections

Decrease in the length of connections in relation to the previous year results from the verification of data under the network passporting process.

Sale of distribution services [GWh]

| Business customers | Households | Total | |

|---|---|---|---|

| 2018 | 15,223 | 4,654 | 19,877 |

| 2019 | 15,051 | 4,713 | 19,764 |

Number of Users (‘000)

| Business customers | |

|---|---|

| 2018 | 2,589 |

| 2019 | 2,626 |

Trading

Sales of electricity and gaseous fuel to retail customers carried out by ENEA S.A.

The results of the Trading Area in 2019 should be assessed taking into account a significant change in the regulatory environment, i.e. the entry into force of the Act of 28 December 2018 amending the Excise Duty Act and certain other acts ("Act").

In FY 2019, the total volume of sales decreased by 1,118 GWh, or by approx. 5%, as compared to FY 2018. A decrease in electricity sales was recorded in the business customers segment (down by 1,307 GWh, i.e. by approx. 8%), which was caused by a change in the portfolio of those customers (lower than in 2018 sales volume in the segment of A and B tariff group customers). Meanwhile, in the households segment the volume of electricity sales increased (by 109 GWh, i.e. by approx. 2%). The volume of gas fuel sales also increased compared to the corresponding period of the previous year (by 80 GWh, i.e. by approx. 8%).

Revenues from the sale of electricity in FY 2019 take into account the adjustment of the Company’s prices and fees to the provisions of the Act of 28 December 2018 on amending the Excise Duty Act and certain other acts and identify revenues resulting from settlements with Zarządca Rozliczeń (Settlement Manager) in form of the price difference amount (H1 2019) and financial compensation (H2 2019), the so-called Compensation. The impact of the Act is described in detail in 10.1.15.

In FY 2019, total sales revenues (without compensation) increased by PLN 197 million, i.e. by approx. 4% when compared to FY 2018. The growth was posted in the revenues from both electricity and gas fuel sales.